By: Vibhuti Pathak

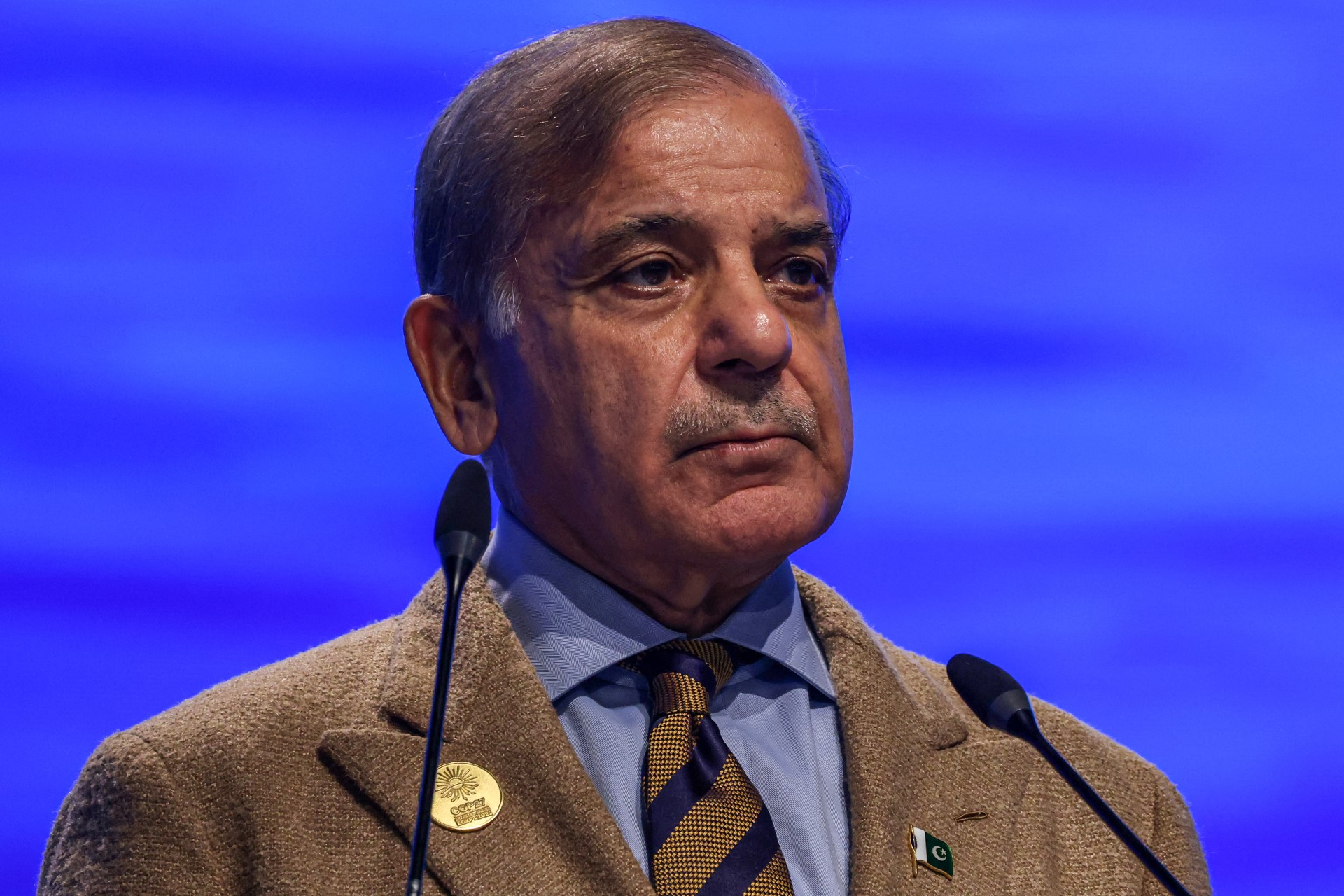

The newly elected PM, Shehbaz Sharif on Friday, gave a statement on Pakistan’s economic indicators. Ahead of the IMF board which is scheduled on Monday, where it will be decided whether the IMF will be lending £88 million funding to the country. They will also be deciding on the disbursement as part of a £2.8 billion standby arrangement Islamabad secured last summer.

The prime minister said, in an address to his cabinet that was telecast live, that exports and remittances had shown a rise within one and a-half months of his government.

Sharif said this with an agenda of painful reforms and privatisation on track. With a chronic balance of payments crisis, Pakistan needs £19 billion in payments for debt and interest servicing in the next fiscal year starting July 1 – three times more than its central bank’s foreign currency reserves.

With a pending debt, Pakistan is seeking yet another long-term, larger IMF loan. The Finance Minister of Pakistan, Muhammad Aurangzeb, said that they could secure a staff-level agreement on the new program by early July. If successful, it would be the 24th IMF bailout for Pakistan.

The IMF-led structural reforms require Pakistan to raise its tax-to-GDP ratio from around 9 per cent to at least 13-14 per cent, stop losses in state-owned enterprises, and manage its energy sector losses which run into trillions of rupees. “It is not just for antibiotics to work anymore. It needs a surgery,” Sharif said.

Pakistan’s finance ministry expects the economy to grow by 2.6 per cent in the current fiscal year ending June, while average inflation is projected to stand at 24 per cent, down from 29.2 per cent in fiscal year 2023/2024. Inflation soared to a record high of 38 per cent last May.

The newly appointed finance minister, Muhammad, had earlier stated to Pakistani media that, “No debates, no waste of time — just a steadfast commitment to implementation,” after the sworn-in ceremony.

However, there will be further challenges associated with the IMF specifically, as Pakistani economists and finance specialists have stated. The first challenge the finance minister would have to overcome is essentially closing the programme so the country can move towards macroeconomic stability. However, unlocking further financial assistance from the IMF would maintain Pakistan’s access to international financial markets. It will offer stability and predictability for implementing economic reforms.

There have been suggestions that debt restructuring is essentially used by the country to avoid the risk of sovereign default on its existing debt. A Debt Sustainability Analysis (DSA) is to be conducted before it decides on lending to a country to ensure they are on a “sustainable development track”.

The IMF says debt restructuring for low-income countries poses different challenges externally and domestically. Domestically, there can be “difficult trade-offs between the need to restructure sovereign debt owed to domestic banks” in addition to impact on financial growth. Externally, this will give rise to coordination challenges due to “increased diversity in the creditor composition”.